Key takeaways

- The USD no longer exhibits a premium amid trade policy uncertainty

- But this creates asymmetric USD upside around upcoming tariff deadlines

- The CAD and EUR look vulnerable to renewed concerns about US trade policy

Our tactical view

Table of tactical views where a currency pair is referenced (e.g. USD/JPY):An up (⬆) / down (⬇) / sideways (➡) arrow indicates that the first currency quotedin the pair is expected by HSBC Global Research to appreciate/depreciate/track sideways against the second currency quoted over the coming weeks. For example, an up arrow against EUR/USD means that the EUR is expected to appreciate against the USD over the coming weeks. The arrows under the “current” represent our current views, while those under “previous” represent our views in the last month’s report.

USD

We incorrectly assumed a month ago that the USD would retain its premium amid trade policy uncertainty, but the absence of the premium creates asymmetric USD upside around upcoming tariff deadlines over the coming weeks. For example, a further delay in the imposition of tariffs on Canada or Mexico on 4 March might see a slightly weaker USD. But if 25% tariffs are imposed, the USD would likely surge higher. On top of tariff developments, markets may focus on US PCE for January (28 February), non-farm payroll report for February (6 March) and February CPI data (12 March), ahead of the Federal Reserve’s 18-19 March meeting. The Fed is likely to keep its policy rate unchanged, but a new round of median interest rate projections (known as “median dots”) and fresh guidance from Fed Chair Powell (post the 4 March tariff deadline) could be critical in setting the tone for the USD, one we expect to be bullish.

Short-term direction : DXY^

Current

▲ Appreciate

Previous

▲ Appreciate

EUR

EUR-USD is back close to the highs seen in January, as markets appear to assume no escalation in US-EU trade tensions and helpful German politics. The prospect of peace talks in the Ukraine/Russia conflict has already proved supportive for the EUR. But the EUR is likely to face downside risks over the coming weeks, as a lot of ‘good news’ is in the price. In addition, the European Central Bank (ECB) is expected to deliver a 25bp cut on 6 March, and there is currently a 60% probability attached to a follow-up cut in April. As the Eurozone still faces a challenging growth-inflation mix, one could argue for more ECB easing.

Short-term direction : EUR-USD

Current

▼ Depreciate

Previous

▼ Depreciate

GBP

Monetary, fiscal and trade policies all pose downside risks to the GBP over the coming weeks. While the Bank of England (BoE) is unlikely to deliver a 25bp rate cut at its 20 March meeting, the market is priced for only c50bp of easing by the end of the year (Bloomberg, 20 February 2025). With a softening labour market, the GBP is likely to face an asymmetric downside risk via the rate differential channel. UK Chancellor Rachel Reeves will present her Spring Statement on 26 March, including updated forecasts, which may squeeze the UK government’s fiscal headroom, likely hurting the GBP. Despite ebbing tariff concerns, global risks remain a threat to the GBP.

Short-term direction : GBP-USD

Current

▼ Depreciate

Previous

▼ Depreciate

JPY

The JPY is likely to hold steady against the USD over the coming weeks, buoyed by its ‘safe haven’ status amid external developments. Domestically, 10-year government bonds continue to rise, supporting the case for further rate hikes by the Bank of Japan (BoJ) this year, but the BoJ hike is unlikely to come on 19 March. The market is priced for one 25bp hike (by September) and a 60% chance of a second 25bp hike before the end of the year (Bloomberg, 20 February 2025). However, USD-JPY looks a little stretched relative to its yield differential, limiting room for the JPY to strengthen further from here. We await news on whether the Government Pension Investment Fund (GPIF) will boost its holdings of domestic assets.

Short-term direction : USD-JPY

Current

▶ Track Sideways

Previous

▲ Appreciate

CHF

Risk appetite and rates remain the drivers of the CHF. It is unclear whether market optimism on external events, like delayed US tariffs and a peace deal in Ukraine, will remain in play. The more likely factor to drive USD-CHF higher remains monetary policy. The Swiss National Bank (SNB) is expected to deliver 25bp cut at its 20 March meeting, with c85% priced by the market (Bloomberg, 20 February 2025). A dovish SNB guidance could weigh on the CHF. Markets may eye on the February CPI print (5 March) for clues.

Short-term direction : USD-CHF

Current

▲ Appreciate

Previous

▲ Appreciate

CAD

USD-CAD has moved lower than what its rate differential has implied, which is peculiar given the still looming threat of 25% US tariffs on 4 March. There could still be another delay, in which we could see a small CAD rally against the USD. But if 25% tariffs are imposed, including those on steel and aluminium announced on 10 Feb, USD-CAD would likely surge higher. The CAD may also come under pressure from a dovish Bank of Canada (BoC) and there is a c20 % chance of a 25bp cut on 12 March. Markets will also eye domestic data including Canadian GDP data (28 February) and labour market data (7 March).

Short-term direction : USD-CAD

Current

▲ Appreciate

Previous

▲ Appreciate

AUD

We extend our tactically optimistic stance on AUD-USD into early March. But uncertainty could quickly ramp up afterwards, as the net impact of China’s fiscal agenda, US policy, local politics, and risk appetite is uncertain. The Reserve Bank of Australia cut its policy rate by 25bp to 4.10% on 18 February, and our view remains that the terminal rate differential will move in the USD’s favour over the medium term.

Short-term direction : AUD-USD

Current

▲ Appreciate

Previous

▲ Appreciate

NZD

NZD-USD could face some near-term upside risks into early March, but rate differentials are likely to favour the USD, with the Reserve Bank of New Zealand cutting its policy rate by 50bp to 3.75% on 19 February. Notably, RBNZ Governor Adrian Orr saw the recent NZD decline as a “welcome impulse” (Bloomberg, 19 February 2025). Uncertainty related to US tariffs and China fiscal policy is also high.

Short-term direction : NZD-USD

Current

▲ Appreciate

Previous

▲ Appreciate

Note: ^DXY = US Dollar Index, is an index (or measure) of the value of the USD against major global currencies, including the EUR, JPY, GBP,CAD, SEK and CHF. Source: HSBC

FX Data Snapshot

(from close on 22 January to 21 February*)

FX |

Spot |

200 dma |

1-month % change* |

Support |

Resistance |

|---|---|---|---|---|---|

| DXY | 106.63 | 104.95 | -1.33% | 105.42 | 108.00 |

| EUR-USD |

1.0476 | 1.0736 | 0.46% | 1.0386 | 1.0533 |

| GBP-USD |

1.2658 | 1.2788 | 2.49% | 1.2400 | 1.2788 |

| USD-JPY |

150.48 | 152.61 | -3.24% | 148.65 | 152.64 |

| USD-CHF |

0.8989 | 0.8829 | -0.78% | 0.8782 | 0.9050 |

| USD CAD |

1.4185 | 1.3898 | -0.96% | 1.4000 | 1.4350 |

| AUD-USD |

0.6389 | 0.6549 | 1.83% | 0.6200 | 0.6550 |

| NZD-USD |

0.5762 | 0.5962 | 1.46% | 0.5600 | 0.5930 |

Note: * as at 16:29 HKT on 21 February 2025

Source: HSBC, Bloomberg

Explanation of terms

Spot: Spot refers to the current market price of a currency pair that is important for immediate transactions.

200 dma: 200-day simple moving average numberrepresents the average price of an index or a currency pair over the past 200 days.

Support (S), Resistance (R):Support and resistance are significant previous lows and highs plus retracement levels, based on historical price patterns of anindex or a currency pair. Support is a historical price level where a downtrend of a currency pair paused due to demand for the first currency quoted in the pair increasing, while resistance is a historical price level where an uptrend of a currency pair reversed amid demand for the second currency quoted in the pair increasing.

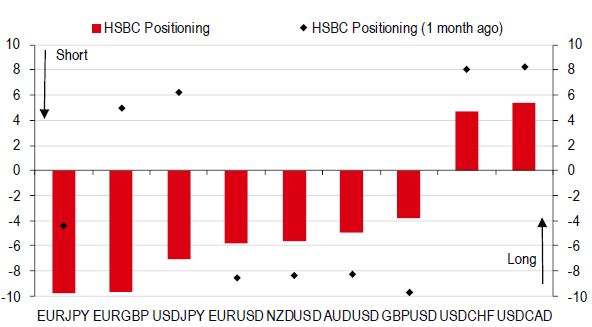

HSBC Positioning Indices

Note: Priced as of market close 20 February 2025

Source: HSBC, Bloomberg

The indicators have been devised to track the net position of momentum traders, looking at hundreds of strategies, operating over many different time horizons. It considers time horizons of 5 days up to 260 days. An indicator level of +10 would indicate that the hundreds of different strategies have all lined up and gone long (i.e., buy the first currency quoted in the pair). Similarly, an indicator level of -10 indicates that all strategies are short (i.e., sell the first currency quoted in the pair).

Glossary

Dovish

Dovish refers to an economic outlook which generally supports low interest rates as a means of encouraging growth within the economy.

Hawkish

Hawkish is typically used to describe monetary policy which favours higher interest rates, and tighter monetary controls to keep inflation in check.

MoM / YoY

Month on month / Year on year

PMI

Purchasing Managers Index (PMI) is an indicator of economic health of the manufacturing sector (>50 represents expansion vs. the previous month).

IMM data

International Monetary Market (IMM) is a division of the Chicago Mercantile Exchange (CME) that deals with the trading of currencies and interest rate futures and options and the IMM data is part of the Commitments of Traders (COT) reports published by the U.S. Commodity Futures Trading Commission (CFTC). The IMM data provides a breakdown of each Tuesday’s open futures positions on the IMM. Speculative positions are a trader’s non-commercial positions (i.e. not for hedging purposes).

G10

G10 refers to the most heavily traded, liquid currencies in the world: USD, EUR, JPY, GBP, CHF, AUD, NZD, CAD, NOK, and SEK.

Fed / FOMC

Federal Reserve System (US’s Central Bank)/Federal Open Market Committee.

ECB

European Central Bank (Eurozone’sCentral Bank).

BOE

Bank of England (UK’s Central Bank).

BOJ

Bank of Japan (Japan’s Central Bank).

BOC

Bank of Canada (Canada’s Central Bank).

RBA

Reserve Bank of Australia (Australia’s Central Bank).

RBNZ

Reserve Bank of New Zealand (New Zealand’s Central Bank).

SNB

Swiss National Bank (Switzerland’s Central Bank).

Important information

Important disclosures

This document is for information purposes only and it should not be regarded as an offer to sell or as a solicitation of an offer to buy the securities or other investment products mentioned in it and/or to participate in any trading strategy. Information in this document is general and should not be construed as personal advice, given it has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on it, consider the appropriateness of the information, having regard to their objectives, financial situation and needs. If necessary, seek professional investment and tax advice.

Certain investment products mentioned in this document may not be eligible for sale in some states or countries, and they may not be suitable for all types of investors. Investors should consult with their HSBC representative regarding the suitability of the investment products mentioned in this document and take into account their specific investment objectives, financial situation or particular needs before making a commitment to purchase investment products.

The value of and the income produced by the investment products mentioned in this document may fluctuate, so that an investor may get back less than originally invested. Certain high-volatility investments can be subject to sudden and large falls in value that could equal or exceed the amount invested. Value and income from investment products may be adversely affected by exchange rates, interest rates, or other factors. Past performance of a particular investment product is not indicative of future results.

HSBC and its affiliates will from time to time sell to and buy from customers the securities/instruments (including derivatives) of companies covered in HSBC Research on a principal or agency basis.

Whether, or in what time frame, an update of this analysis will be published is not determined in advance.

Additional disclosures

- This report is dated as at 21 February 2025.

- All market data included in this report are dated as at close 20 February 2025, unless a different date and/or a specific time of day is indicated in the report.

- HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business.Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

- You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.

Disclaimer

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document is for general circulation and information purposes only. This document is not prepared with any particular customers or purposes in mind and does not take into account any investment objectives, financial situation or personal circumstances or needs of any particular customer. HBAP has prepared this document based on publicly available information at the time of preparation from sources it believes to be reliable but it has not independently verified such information. The contents of this document are subject to change without notice.

This document is not investment advice or recommendation nor is it intended to sell investments or services or solicit purchases or subscriptions for them. You SHOULD NOT use or rely on this document in making any investment decision or decision to buy or sell currency. HBAP is not responsible for such use or reliance by you. You SHOULD consult your professional advisor in your jurisdiction if you have any questions regarding the contents of this document.

You SHOULD NOT reproduce or further distribute the contents of this document to any person or entity, whether in whole or in part, for any purpose. This document may not be distributed to the US, Canada or Australia or any other jurisdiction where its distribution is unlawful.

Jersey, Guernsey and Isle of Man

In Jersey, Guernsey and the Isle of Man, this document is distributed to its customers for general reference only by HSBC Bank plc Jersey branch, HSBC Bank plc Guernsey branch and HSBC Bank plc in the Isle of Man.

Mainland China

In mainland China, this document is distributed by HSBC Bank (China) Company Limited (“HBCN”) to its customers for general reference only. This document is not, and is not intended to be, for the purpose of providing securities and futures investment advisory services or financial information services, or promoting or selling any wealth management product. This document provides all content and information solely on an "as-is/as-available" basis. You SHOULD consult your own professional adviser if you have any questions regarding this document.

Hong Kong

In Hong Kong, this document is distributed by HBAP to its customers for general reference only. HBAP is not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use or reliance of this document. HBAP gives no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document.

India

In India, this document is distributed for general reference by The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), having its India corporate office at 52/60, Mahatma Gandhi Road, Fort, Mumbai 400 001. HSBC India is not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document. HSBC India gives no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document and clients should contact their relationship manager in respect of any clarifications arising from or in connection with this document.

Malaysia

In Malaysia, this document has been prepared by HBAP is issued and distributed by HSBC Bank Malaysia Berhad (127776-V) / HSBC Amanah Malaysia Berhad (807705-X) (the "Bank"). The Bank is not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result, of arising from or relating to your use of or reliance on this document.

Singapore

In Singapore, this document is distributed by HSBC Bank (Singapore) Limited (“HBSP”) pursuant to Regulation 32C of the Financial Advisers Regulations, to its customers for general reference only. HBSP accepts legal responsibility for the contents of this document, and may be contacted in respect of any matters arising from, or in connection with, this document. Please refer to HBSP’s website at www.hsbc.com.sg for its contact details.

Taiwan

In Taiwan, this document is distributed by HSBC Bank (Taiwan) Limited, [13F/14F No 333, section 1 Keelong Rd, Taipei] to its customers for general reference only. HSBC Bank (Taiwan) Limited is not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use or reliance of this document. Clients of HSBC Bank (Taiwan) Limited should contact their relationship manager in respect of any matters arising from or in connection with this document.

United Arab Emirates

In the UAE, this document is distributed by HSBC Bank Middle East Limited (“HBME”) U.A.E Branch, P.O.Box 66, Dubai, U.A.E, which is regulated by the Central Bank of the U.A.E and lead regulated by the Dubai Financial Services Authority. In respect of certain financial services and activities offered by HBME, it is regulated by the Securities and Commodities Authority in the UAE under license number 602004. HBME is not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document.

Miscellaneous

Notwithstanding this document is not investment advice, please be aware of the following for the sake of completeness. Past performance is not an indication of future performance. The value of any investment or income may go down as well as up and you may not get back the full amount invested. When an investment is denominated in a currency other than the local currency of an investor, changes in the exchange rates may have an adverse effect on the value, price or income of that investment. Where there is no recognised market for an investment, it may be difficult for an investor to sell the investment or to obtain reliable information about its value or the extent of the risk associated with it.

This document contains forward-looking statements which are, by their nature, subject to significant risks and uncertainties. Such statements are projections, do not represent any one investment and are used for illustration purpose only. Customers are reminded that there can be no assurance that economic conditions described herein will remain in the future. Actual results may differ materially from the forecasts/estimates. No assurance is given that those expectations reflected in those forward-looking statements will prove to have been correct or come to fruition, and you are cautioned not to place undue reliance on such statements. No obligation is undertaken to publicly update or revise any forward-looking statements contained in this document or any other related document whether as a result of new information, future events or otherwise.

The Hongkong and Shanghai Banking Corporation Limited, its affiliates and associates and their respective officers and/or employees, may have interests in any products referred to in this document by acting in various roles including as distributor, holder of principal positions, adviser or lender. The Hongkong and Shanghai Banking Corporation Limited, its affiliates and associates, and their respective officers and employees, may receive fees, brokerage or commissions for acting in those capacities. In addition, The Hongkong and Shanghai Banking Corporation Limited, its affiliates and associates, and their respective officers and/or employees, may buy or sell products as principal or agent and may effect transactions which are not consistent with the information set out in this document.

© Copyright 2024. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED. No part of this document may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.