9 October 2024

Customer pressure and regulations are driving demand for green alternatives to traditional plastic materials. These materials are generally perceived to be eco-friendly alternatives to conventional plastic. However, the terminology around alternative plastics is confusing and can easily lead to consumer misperceptions on their sustainability.

In this issue of #WhyESGMatters, we look at four key myths surrounding alternative plastic nomenclature. We explain why investors should think not only about creating plastic alternatives, but about how to encourage a circular economy mindset. This can include better labelling and consumer education.

Source: European Bioplastics, Leela Dilkes-Hoffman, et. Al., Public attitudes towards bioplastics – knowledge, perception and end-of-life management, Resources, Conservation and Recycling, 2019, HSBC estimates.

The pressure to reduce plastic waste, especially from single-use plastics, is mounting on corporates from regulators, investors and consumers. Among elimination and reuse solutions, companies are investing in innovative “green” alternative plastics, sometimes called bioplastics, that look and feel like traditional plastic but are made from biomass and/or have biodegradable properties – think compostable utensils and biobased water bottles. These materials are generally perceived to be eco-friendly alternatives to conventional plastics by reducing fossil fuel use, greenhouse gas (GHG) emissions and/or plastic pollution.

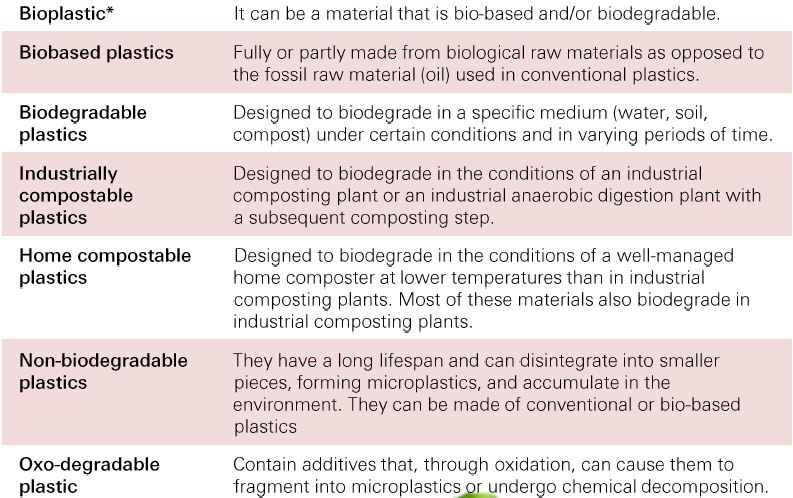

Overview of alternative plastics: Important terms

* For the purpose of this report we define these alternative plastic key terms according to the European Environmental Agency. However, there’s no globally recognised definition for these terms and this has led to widespread confusion by the general public on these materials.

Source: European Environment Agency

The myth

The reality

It’s all in the mix: Biomass and petroleum sources are often mixed to maintain the durability and quality associated with traditional plastics. There is no universally agreed-upon threshold to define the minimum biobased content needed for a material to be classified as biobased, and the existing certified labels often have low biobased thresholds.

For example, the USDA BioPreferred labelling programme certifies products which meet a minimum biobased content requirement of 25%. Similarly, products with the OK Biobased certified label, often used in the EU, indicate that they have at least 20% biobased materials. Manufacturers often self-label products with biobased terminology, which brings little transparency to the actual biomass content. Other terminology like “bioplastic” “plant-based” and “renewable materials” are also used interchangeably with “biobased” on packaging, adding confusion to customers.

Not all biobased products are created equally. The biomass source, the production process, and the final properties of the material can all have varying environmental impacts. It’s important to consider that biobased terminology isn’t always indicative of environmental impacts.

The myth

The reality

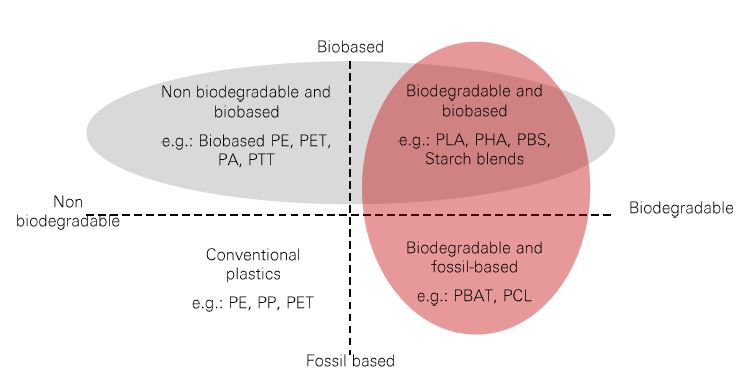

It’s all down to chemistry: In fact, on a molecular level, many biobased plastics are identical to their fossil fuel alternatives and last just as long in nature. Whether these non-biodegradable biobased plastics are recyclable depends on their chemical composition. For example, some biobased (non-biodegradable) materials can be recycled through current collection infrastructure, while others need their own specialised recycling process. It’s crucial to keep in mind that just because a material is biobased doesn’t mean it’s biodegradable, and vice versa.

Biobased packaging isn’t always biodegradable

Source: Bio-plastics Europe, HSBC

The myth

The reality

Try this one at an industrial facility: The term “biodegradable” gives no parameters for how quickly and under what conditions a material can biodegrade. Therefore, regulators across the globe are promoting the use of “compostable” terminology to describe alternative packaging – which means a product meets the requirements to biodegrade under the conditions associated with an industrial composting facility. Contrary to an at-home composter, these facilities expose the material to high temperatures and certain microbes essential for biodegradation.

And now, the small print: Currently, many countries have adopted compostability standards for alternative plastics. These include the International Organisation for Standardisation (ISO) international benchmark for compostable plastics (ISO 17088), in addition to country-specific standards, such as ASTM 6400 in the US and EN 13432 in the EU. Generally speaking, standards classify a material as “compostable” if a minimum of 90% of the material can biodegrade in an industrial compost environment within 6 months.

The myth

The reality

Don’t try this one at home: As discussed in myth three, 3rd party certified industrial composting labels are available, but this doesn’t mean that such packaging can be thrown into home or community composting facilities. Although you may find some alternative packaging labelled as ‘home compostable’, the varying environments within home composting equipment provide no guarantee that these materials will fully degrade.

The take-back that isn’t: Limited access to industrial composting facilities and confusion between words like “compostable”, “home compostable” and “industrial compostable” can bring challenges to the disposal of alternative plastic materials. A UK study showed that 60% of sampled items, which were attempted to be home-compost by citizens, weren’t certified for home processing.[@why-esg-matters-05-03] As a result, many composting facilities choose not to take compostable packaging materials due to concerns about potential contamination of compost with chemicals in packaging and inadequate product labelling being insufficient to ensure packaging is certified compostable.[@why-esg-matters-05-04]

The emerging alternative plastic industry not only faces challenges in integrating sustainable practices, but also in production scale and cost constraints. However, the landscape around alternative plastics is rapidly evolving – there are a growing number of materials, applications and products entering the market. We think scientific advancements and growing international commitments to reducing plastics will help drive innovation.

In a collective initiative organised by Planet Tracker, investors with a total USD6.8trn in assets called on petrochemical companies to reduce fossil fuel reliance and eliminate toxic chemicals in plastics. Additionally, the 5th session of the Intergovernmental Negotiating Committee, which aims at developing an international legally binding instrument on plastic pollution, will happen later this year – putting plastics on the global agenda.

Many companies have set goals to replace their single-use plastics with alternatives. Nonetheless, given the opaque sustainability of these “green” plastics, we think companies need to better understand their green packaging claims and build guardrails to avoid misleading consumers. Key company considerations include:

Identifying purpose – It’s essential to have a clear understanding of packaging claims and supply chain implications. Additionally, companies should assess whether the decision to use alternative plastics aligns with their strategic objectives, compared to other plastic solution, e.g. elimination and reuse.

Consumer education – Whether there’s clear consumer awareness of products and their sustainable uses. This includes providing information about how materials can be properly disposed of to have the most sustainable impact.

Labelling – Understanding the certification and standards in operating regions and providing credible third-party labels that bring integrity and transparency to the material.

Waste infrastructure – Whether waste infrastructure is available to their customer base, and/or how they can promote more efficient recycling and composting systems.

Alternative plastics can be potential solution to the plastics problem, addressing their associated GHG emissions and waste. However, as the market for alternative plastics matures, it’s crucial to address the complexities of sustainability and consumer education to ensure that the potential environmental benefits of these can be fully realised. We think companies and investors should focus not only on creating plastic alternatives, but also on encouraging a circular economy mindset, looking for ways to reduce, reuse, and recycle plastics, as well as how readily plastics can be broken down in a non-harmful, non-toxic and cost-effective manner.

We also expect to see more regulations around product labelling, which will provide customers with better clarity. Companies that choose to use alternative plastics who align with verified third-party labelling, promote consumer education, and consider readily available waste infrastructure, give themselves the best chance to take advantage of the environmental benefits of alternative plastics.

1. This report is dated as at 8 October 2024.

2. All market data included in this report are dated as at close 7 October 2024, unless a different date and/or a specific time of day is indicated in the report.

3. HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC’s analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC’s Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

4. You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument.

This document or video is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document or video is distributed and/or made available, HSBC Bank (China) Company Limited, HSBC Bank (Singapore) Limited, HSBC Bank Middle East Limited (UAE), HSBC UK Bank Plc, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (20080100642 1 (807705-X)), HSBC Bank (Taiwan) Limited, HSBC Bank plc, Jersey Branch, HSBC Bank plc, Guernsey Branch, HSBC Bank plc in the Isle of Man, HSBC Continental Europe, Greece, The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank (Vietnam) Limited, PT Bank HSBC Indonesia (HBID), HSBC Bank (Uruguay) S.A. (HSBC Uruguay is authorised and oversought by Banco Central del Uruguay), HBAP Sri Lanka Branch, The Hongkong and Shanghai Banking Corporation Limited – Philippine Branch, HSBC Investment and Insurance Brokerage, Philippines Inc, and HSBC FinTech Services (Shanghai) Company Limited and HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group (collectively, the “Distributors”) to their respective clients. This document or video is for general circulation and information purposes only.

The contents of this document or video may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document or video must not be distributed in any jurisdiction where its distribution is unlawful. All non-authorised reproduction or use of this document or video will be the responsibility of the user and may lead to legal proceedings. The material contained in this document or video is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document or video may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HBAP and the Distributors do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document or video has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed are based on the HSBC Global Investment Committee at the time of preparation and are subject to change at any time. These views may not necessarily indicate HSBC Asset Management‘s current portfolios’ composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients’ objectives, risk preferences, time horizon, and market liquidity.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. Past performance contained in this document or video is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in emerging markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Investments are subject to market risks, read all investment related documents carefully.

This document or video provides a high-level overview of the recent economic environment and has been prepared for information purposes only. The views presented are those of HBAP and are based on HBAP’s global views and may not necessarily align with the Distributors’ local views. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. It is not intended to provide and should not be relied on for accounting, legal or tax advice. Before you make any investment decision, you may wish to consult an independent financial adviser. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether the investment product is suitable for you. You are advised to obtain appropriate professional advice where necessary.

The accuracy and/or completeness of any third-party information obtained from sources which we believe to be reliable might have not been independently verified, hence Customer must seek from several sources prior to making investment decision.

The following statement is only applicable to HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group with regard to how the publication is distributed to its customers: This publication is distributed by Wealth Insights of HSBC México, and its objective is for informational purposes only and should not be interpreted as an offer or invitation to buy or sell any security related to financial instruments, investments or other financial product. This communication is not intended to contain an exhaustive description of the considerations that may be important in making a decision to make any change and/or modification to any product, and what is contained or reflected in this report does not constitute, and is not intended to constitute, nor should it be construed as advice, investment advice or a recommendation, offer or solicitation to buy or sell any service, product, security, merchandise, currency or any other asset.

Receiving parties should not consider this document as a substitute for their own judgment. The past performance of the securities or financial instruments mentioned herein is not necessarily indicative of future results. All information, as well as prices indicated, are subject to change without prior notice; Wealth Insights of HSBC Mexico is not obliged to update or keep it current or to give any notification in the event that the information presented here undergoes any update or change. The securities and investment products described herein may not be suitable for sale in all jurisdictions or may not be suitable for some categories of investors.

The information contained in this communication is derived from a variety of sources deemed reliable; however, its accuracy or completeness cannot be guaranteed. HSBC México will not be responsible for any loss or damage of any kind that may arise from transmission errors, inaccuracies, omissions, changes in market factors or conditions, or any other circumstance beyond the control of HSBC. Different HSBC legal entities may carry out distribution of Wealth Insights internationally in accordance with local regulatory requirements.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”)

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India is a distributor of mutual funds and referrer of investment products from third party entities registered and regulated in India. HSBC India does not distribute investment products to those persons who are either the citizens or residents of United States of America (USA), Canada, Australia or New Zealand or any other jurisdiction where such distribution would be contrary to law or regulation.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/ business. However, the Bank disclaims any guarantee on the management or operation performance of the trust business.

The following statement is only applicable to PT Bank HSBC Indonesia (“HBID”): PT Bank HSBC Indonesia (“HBID”) is licensed and supervised by Indonesia Financial Services Authority (“OJK”). Customer must understand that historical performance does not guarantee future performance. Investment product that are offered in HBID is third party products, HBID is a selling agent for third party product such as Mutual Fund and Bonds. HBID and HSBC Group (HSBC Holdings Plc and its subsidiaries and associates company or any of its branches) does not guarantee the underlying investment, principal or return on customer investment. Investment in Mutual Funds and Bonds is not covered by the deposit insurance program of the Indonesian Deposit Insurance Corporation (LPS).

Important information on ESG and sustainable investing

In broad terms “ESG and sustainable investing” products include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors to varying degrees. Certain instruments we classify as sustainable may be in the process of changing to deliver sustainability outcomes. There is no guarantee that ESG and Sustainable investing products will produce returns similar to those which don’t consider these factors. ESG and Sustainable investing products may diverge from traditional market benchmarks. In addition, there is no standard definition of, or measurement criteria for, ESG and Sustainable investing or the impact of ESG and Sustainable investing products. ESG and Sustainable investing and related impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the ESG / sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of ESG / sustainability impact will be achieved. ESG and Sustainable investing is an evolving area and new regulations are being developed which will affect how investments can be categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.

THE CONTENTS OF THIS DOCUMENT OR VIDEO HAVE NOT BEEN REVIEWED BY ANY REGULATORY AUTHORITY IN HONG KONG OR ANY OTHER JURISDICTION. YOU ARE ADVISED TO EXERCISE CAUTION IN RELATION TO THE INVESTMENT AND THIS DOCUMENT OR VIDEO. IF YOU ARE IN DOUBT ABOUT ANY OF THE CONTENTS OF THIS DOCUMENT OR VIDEO, YOU SHOULD OBTAIN INDEPENDENT PROFESSIONAL ADVICE.

© Copyright 2025. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document or video may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.