We're enhancing your Personal Internet Banking experience

Your Personal Internet Banking experience with HSBC is evolving for the better. Our new design makes it easier for you to manage your accounts and finances online with HSBC.

You'll start to notice a refreshed look and enhancement of our features gradually over the coming months

What's changing?

- A simplified new design, based around you and your banking needs

- Mobile and tablet friendly screens, allowing you to use Personal Internet Banking wherever you are

What's new?

Digital Secure Key

The Digital Secure Key on ‘HSBC India’ app replaces your physical Security Device, allowing you to generate security codes to log on to online banking or verify transactions requiring higher level of authentication. That means you would no longer need to use your physical Security Device anymore. Digital banking just got easier.

Once you've activated Digital Secure Key on your mobile banking app, security codes generated from the physical Security Device will no longer be valid and you'll no longer need the physical Security Device. This ensures log on and transaction authentication remains as secure as ever and is faster and convenient.

Online Dispute Resolution

You can easily raise a dispute or report a fraudulent transaction with our online dispute resolution feature. This is available through HSBC India Personal Internet Banking or mobile banking. You can raise disputes for your debit card, credit card, current account, and savings account.

You can raise a dispute up to a certain number of days after the transaction:

- Debit or credit card - up to 120 days from the transaction

- Current or savings account - up to 90 days from the transaction (except debit card transactions)

- ATM cash withdrawal - up to 60 days from the transaction

You can raise your dispute by following these steps:

- Log on to your HSBC India Personal Internet Banking or mobile banking account.

- Go to your accounts, then select your debit card, credit card, current account or savings account.

- Choose the transaction you'd like to dispute.

- Select the option to raise a dispute.

- Indicate the type of dispute you'd like to raise.

- Share the details of the transaction with us.

- Submit your request.

Take a look at our early enhancements

“Update nomination” feature is now live. You can now add and amend nominee on your individual savings, current and fixed deposit accounts through HSBC India Personal Internet Banking. Below are the steps to update your nomination:

- Log on to HSBC India Personal Internet Banking

- Click on “Account Services” > “Manage your accounts”

- Choose “Add Nomination” to add a nominee or choose “Manage Nomination” to view and change your existing nomination

- Once you choose “Add” or “Manage” nominee, select the account for which you want to update the nomination.

- Fill in all the details as required

- Click on “Continue”

You can also access the nomination option directly after booking a new fixed deposit.

- Our new Internet Banking Homepage will show your refined account details with the new look, allowing you to experience HSBC Personal Internet Banking.

- Our new move money feature will start to replace the traditional transfer options, making it simpler for you to move money between accounts and set up payments.

- Our new Logon journey will be replacing the current one making it simpler and faster, whilst being just as secure as it has always been.

- We have launched a brand new feature! If your HSBC Credit Card is damaged, you can now order a replacement card online in just a few clicks.

Service change you need to know

Increase in transfer limits

Effective 27 March 2020, we have increased the limits for third party transfer from INR1,500,000 (15 Lakhs) to INR3,000,000 (30 Lakhs). You can now make such NEFT/RTGS/HSBC third party transfers using online banking from the convenience of your home.

How can you increase your transfer limit?

- Log on to Personal Internet Banking (online banking)

- Increase your third party transfer limits as per your requirements (30 Lakhs max) using the option "Internet banking limits" under "move money" tab

- Wait for 24 hours for these limits to be effective

- Start transferring funds up to the new limits

Please note the daily transfer limit is combined for Personal Internet Banking and Mobile Banking.

Features & Benefits

In today's demanding world, you need instant banking solutions for a better lifestyle. Presenting HSBC's Internet Banking service that gives you complete control over your bank and credit card accounts online. Now bank from the comfort of your home or office, from around India or around the world - anywhere, anytime, whenever suits you best.

HSBC's Internet Banking is quick, easy and secure, allowing you access to a wide range of transactions such as utility bill payments, Fund transfers to your own HSBC accounts in India, viewing e-statements etc. Mentioned below are the features and benefits of HSBC's Internet Banking services.

Complete control over accounts

- View your bank account / credit card balances and transactions at your convenience

- Transfer funds online to accounts with HSBC and other banks in India.

- Create and manage Fixed Deposits

- Say goodbye to queues and missed dates. Pay your credit card and utility bills and insurance premiums online

- Request for E-Statements for your bank account and credit card.

- Manage your investments - buy, redeem and switch between mutual funds* online

- You can also stop cheques, order new cheque books, redeem bonus reward points and more using HSBC's internet banking service

Security

At HSBC, we endeavour to ensure a secure environment for your HSBC Personal Internet Banking experience. A wide range of services are available to you through HSBC Personal Internet Banking. Most of these services would be available to you post logon. However, to safeguard your account further, certain sensitive services require a higher level of authentication using a security code from Digital Secure Key/physical Security Device.

Register for Internet Banking

Services |

Service Charges and Fees |

|---|---|

Account enquires/ Credit Card enquires |

Free |

Open Fixed Deposits |

Free |

HSBC Credit Card Payment |

Free |

Transfer to own accounts within HSBC |

Free |

Transfer to third party accounts within HSBC |

Free |

Transfer to other bank accounts through NEFT (With effect from from 01 January 2020) |

Free |

Transfer to other bank accounts through RTGS (With effect from 01 July 2019) |

₹2 lacs up to ₹5 lacs: ₹19 per transaction ₹5 lacs and above: ₹44 per transaction |

Change of maturity instructions |

Free |

E-Statements |

Free |

Cheque Book Request |

Free |

Cashier Orders |

Free |

Demand Drafts |

Free |

Stop Payments (Saving Accounts) |

₹100 per request |

Request for Duplicate Statement |

₹100 per statement cycle (Quarterly for Savings Accountsand Monthly for Advance Accounts) |

Bill Pay Facility |

Free |

Security Device |

Free |

Services |

Account enquires/ Credit Card enquires |

|---|---|

Service Charges and Fees |

Free |

Services |

Open Fixed Deposits |

Service Charges and Fees |

Free |

Services |

HSBC Credit Card Payment |

Service Charges and Fees |

Free |

Services |

Transfer to own accounts within HSBC |

Service Charges and Fees |

Free |

Services |

Transfer to third party accounts within HSBC |

Service Charges and Fees |

Free |

Services |

Transfer to other bank accounts through NEFT (With effect from from 01 January 2020) |

Service Charges and Fees |

Free |

Services |

Transfer to other bank accounts through RTGS (With effect from 01 July 2019) |

Service Charges and Fees |

₹2 lacs up to ₹5 lacs: ₹19 per transaction ₹5 lacs and above: ₹44 per transaction |

Services |

Change of maturity instructions |

Service Charges and Fees |

Free |

Services |

E-Statements |

Service Charges and Fees |

Free |

Services |

Cheque Book Request |

Service Charges and Fees |

Free |

Services |

Cashier Orders |

Service Charges and Fees |

Free |

Services |

Demand Drafts |

Service Charges and Fees |

Free |

Services |

Stop Payments (Saving Accounts) |

Service Charges and Fees |

₹100 per request |

Services |

Request for Duplicate Statement |

Service Charges and Fees |

₹100 per statement cycle (Quarterly for Savings Accountsand Monthly for Advance Accounts) |

Services |

Bill Pay Facility |

Service Charges and Fees |

Free |

Services |

Security Device |

Service Charges and Fees |

Free |

Compare service features

| Features |

Login with Passwords |

Login with Digital Secure Key/Security Device |

|---|---|---|

| View India (domestic) and international HSBC accounts |

Yes | Yes |

| Search transaction history |

Yes |

Yes |

| Open new Fixed Deposit Account |

No | Yes |

| View your linked countries/territories |

No | Yes |

| Features |

View India (domestic) and international HSBC accounts |

|---|---|

| Login with Passwords |

Yes |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Search transaction history |

| Login with Passwords |

Yes |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Open new Fixed Deposit Account |

| Login with Passwords |

No |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

View your linked countries/territories |

| Login with Passwords |

No |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Login with Passwords |

Login with Digital Secure Key/Security Device |

|---|---|---|

| Quick Move Money |

Yes |

Yes |

| Insta Bill Pay |

Yes |

Yes |

| Pay and Transfer |

Below INR 10 Lakhs only |

Yes |

| Your beneficiaries |

Yes |

Yes |

| Manage billers |

Yes |

Yes |

| Add beneficiary/biller |

No |

Yes |

| Manage future request |

Yes |

Yes |

| Bill payment history enquiry |

Yes |

Yes |

| Manage future bill payments |

Yes |

Yes |

| Features |

Quick Move Money |

|---|---|

| Login with Passwords |

Yes |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Insta Bill Pay |

| Login with Passwords |

Yes |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Pay and Transfer |

| Login with Passwords |

Below INR 10 Lakhs only |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Your beneficiaries |

| Login with Passwords |

Yes |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Manage billers |

| Login with Passwords |

Yes |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Add beneficiary/biller |

| Login with Passwords |

No |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Manage future request |

| Login with Passwords |

Yes |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Bill payment history enquiry |

| Login with Passwords |

Yes |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Manage future bill payments |

| Login with Passwords |

Yes |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Login with Passwords |

Login with Digital Secure Key/Security Device |

|---|---|---|

| View wealth portfolio |

Yes |

Yes |

| Risk profiler |

Yes |

Yes |

| Mutual Funds |

Yes |

Yes |

| Features |

View wealth portfolio |

|---|---|

| Login with Passwords |

Yes |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Risk profiler |

| Login with Passwords |

Yes |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Mutual Funds |

| Login with Passwords |

Yes |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Login with Passwords |

Login with Digital Secure Key/Security Device |

|---|---|---|

| Statements and certificates |

Yes |

Yes |

| Rename your accounts |

Yes |

Yes |

| Stop cheque |

Yes |

Yes |

| Order chequebook |

No |

Yes |

| Apply a personal loan |

Yes |

Yes |

| Internet Banking limits |

Decrease limit only |

Yes (Increase limit, for decrease limit a key is not required) |

| Change password or password reset questions |

No |

Yes |

| Send secure message |

Read only |

Yes (Read and Write) |

| Order a replacement credit card |

No |

Yes |

| Your details |

No |

Yes |

| Features |

Statements and certificates |

|---|---|

| Login with Passwords |

Yes |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Rename your accounts |

| Login with Passwords |

Yes |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Stop cheque |

| Login with Passwords |

Yes |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Order chequebook |

| Login with Passwords |

No |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Apply a personal loan |

| Login with Passwords |

Yes |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Internet Banking limits |

| Login with Passwords |

Decrease limit only |

| Login with Digital Secure Key/Security Device |

Yes (Increase limit, for decrease limit a key is not required) |

| Features |

Change password or password reset questions |

| Login with Passwords |

No |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Send secure message |

| Login with Passwords |

Read only |

| Login with Digital Secure Key/Security Device |

Yes (Read and Write) |

| Features |

Order a replacement credit card |

| Login with Passwords |

No |

| Login with Digital Secure Key/Security Device |

Yes |

| Features |

Your details |

| Login with Passwords |

No |

| Login with Digital Secure Key/Security Device |

Yes |

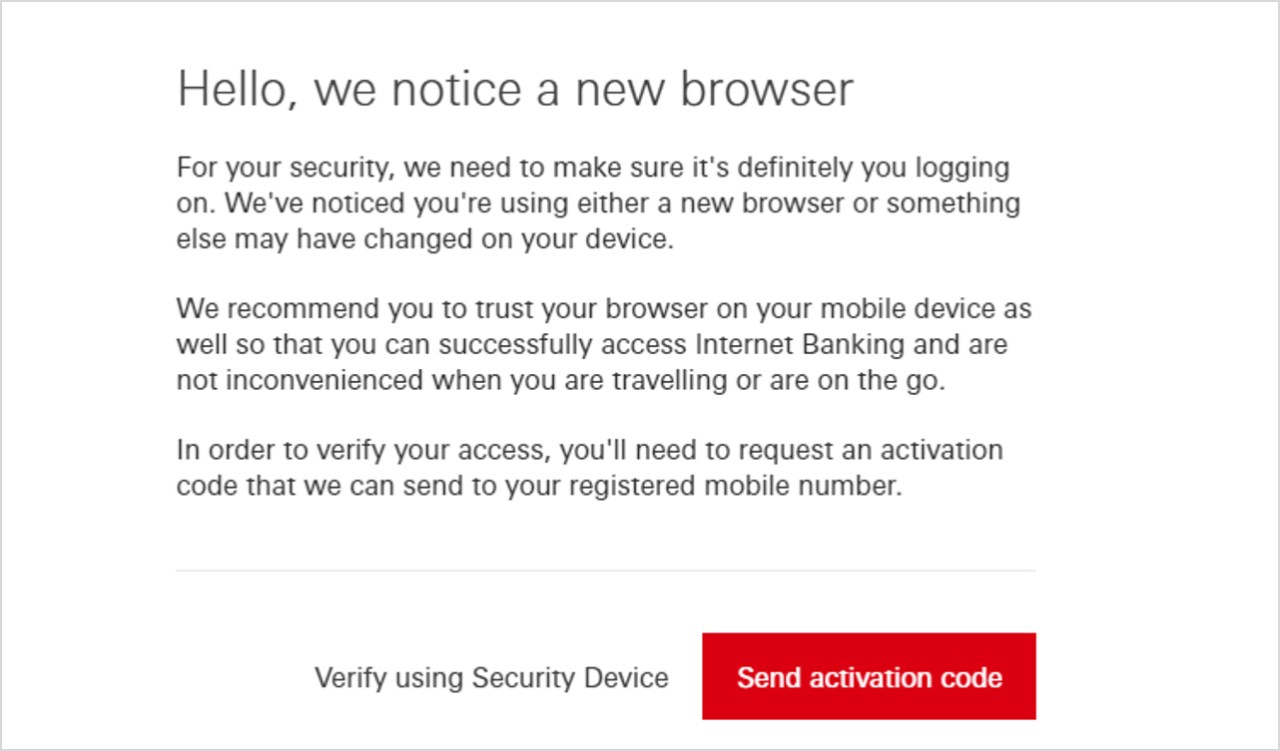

Trusted Browser

We're enhancing the security features on HSBC Personal Internet Banking shortly. This enhancement is an additional layer of security that will help prevent unauthorised access to your accounts.

With the enhancement, you will be required to verify the browser you use to log on to HSBC Personal Internet Banking.

Ways to verify your browser

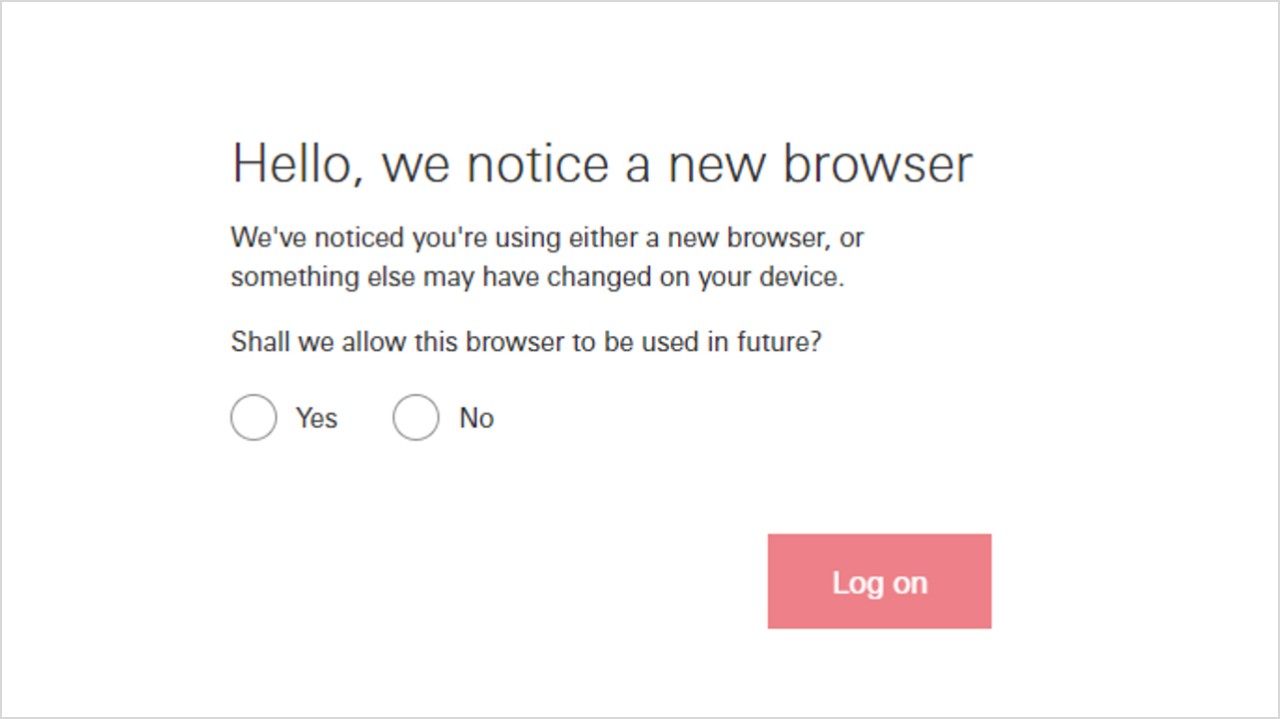

1. When you log on with Digital Secure Key/physical Security Device

You will be prompted to verify the browser you are logging on from. The way this prompt will appear is as given below. You will have a choice to trust this browser for all future logons. Alternately, if you choose not to, you will be prompted to verify the browser each time you log on to Internet Banking.

2. When you log on with password and have a Digital Secure Key/physical Security Device

If you have logged on with password and have a Digital Secure Key/physical Security Device, you also have the option to verify the browser with a code that can be instantly generated on the Digital Secure Key/physical Security Device.

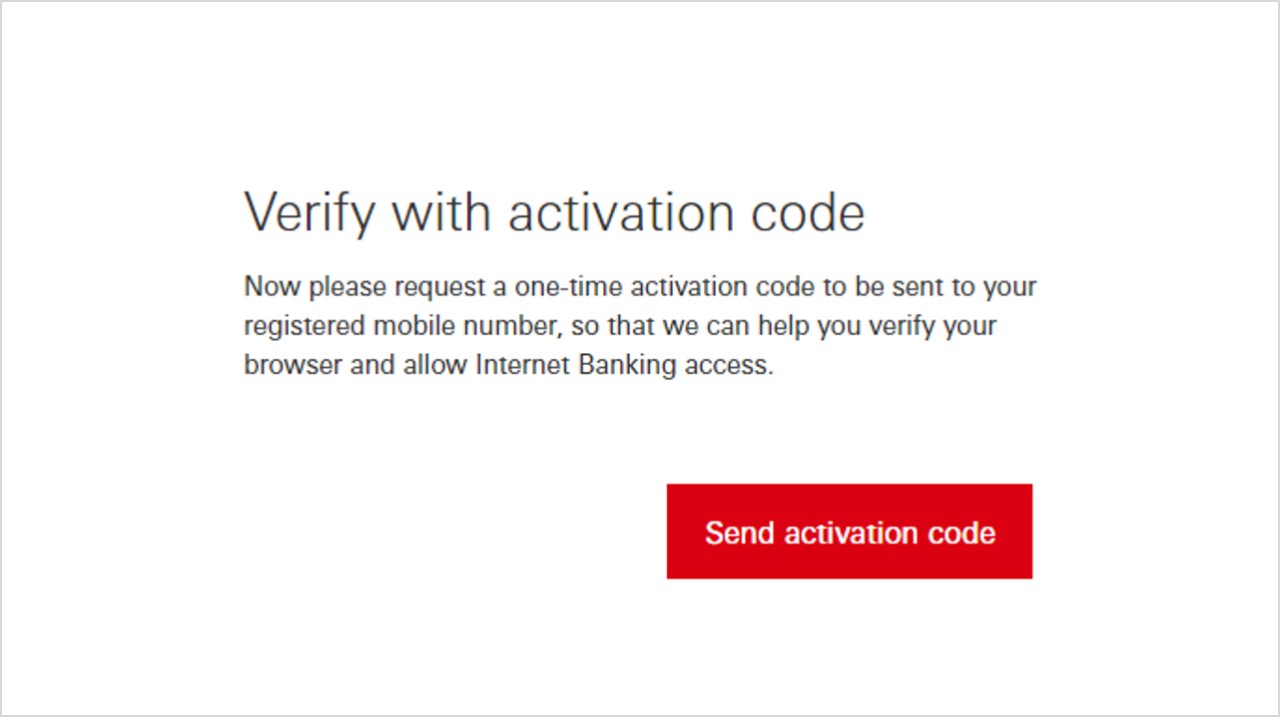

3. When you log on with Password

You will see the screen as shown below. This will allow you to request a one-time activation code on your registered mobile number. You can then enter the one-time activation code to verify the browser for current and future log ons.