Planning and investing for a better quality of life

The HSBC Quality of Life Report captures insights from 11,230 affluent investors across 11 markets, to understand what they consider to be a good quality of life.

This report explores the relationship between physical and mental wellness, and financial fitness. It highlights people's life priorities and preparedness towards wealth management and financial planning – and how they evolve across generations.

Key findings

What is Quality of Life?

In our Quality of Life Report 2024, we asked more than 11,200 people around the world what they'd define as a good quality of life.

The Quality of Life Index is an average score that's derived from a multidimensional concept. This concept covers physical and mental wellness, and financial fitness. The average index is currently 76. That's one point up from 2023.

How the three dimensions connect

The three dimensions are highly interconnected. Those who score high on physical wellness are 10.3× as likely to score above average on mental wellness too. And those who score above average on mental wellness are 3.7× as likely to score high on physical wellness.

Plus, spending time with friends and family, socialising and volunteering all go towards improving a person's quality of life.

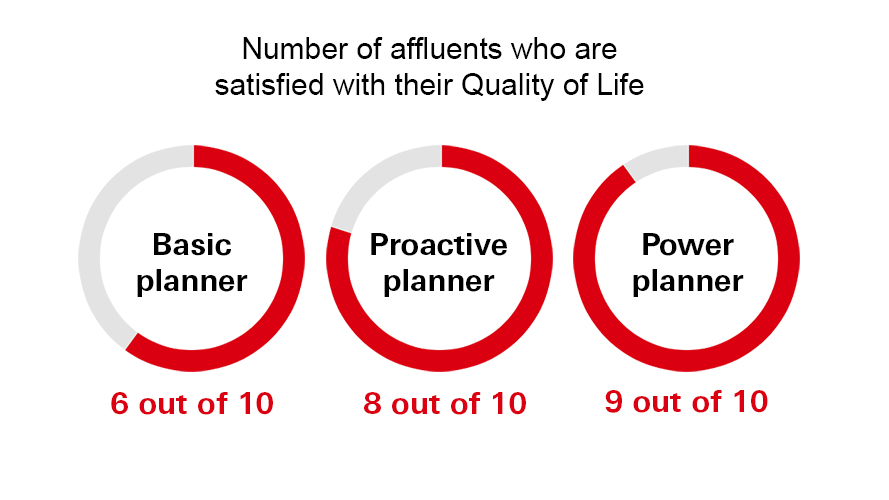

Power Planners score higher

Only 19% of the affluent are Power Planners across all 4 financial planning pillars. These are: healthcare protection, wealth accumulation, retirement and legacy planning. Those who are proactive in their financial planning report 50% more satisfaction with their quality of life. This is in comparison to Basic Planners.

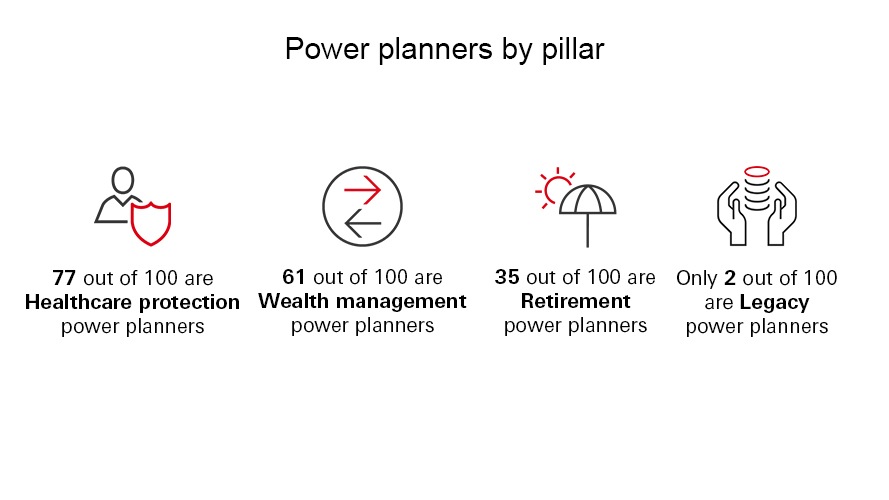

How well are the affluent planning?

The 4 key pillars of a comprehensive financial plan are healthcare protection, retirement, wealth accumulation, and legacy. Individuals tend to excel in planning for healthcare protection. But they fall short when it comes to addressing their legacy.

Improve your quality of life with HSBC

The HSBC Quality of Life Report

Explore full report

Download the global edition of the HSBC Quality of Life Report.

Find out my Quality of Life score

Tell us about your lifestyle and we'll calculate your score. We'll ask about your financial knowledge, planning habits, fitness, and mindset. You'll also get tips that will help you set achievable goals and increase your quality of life. You can come back and calculate your score in the future to see if it improves.